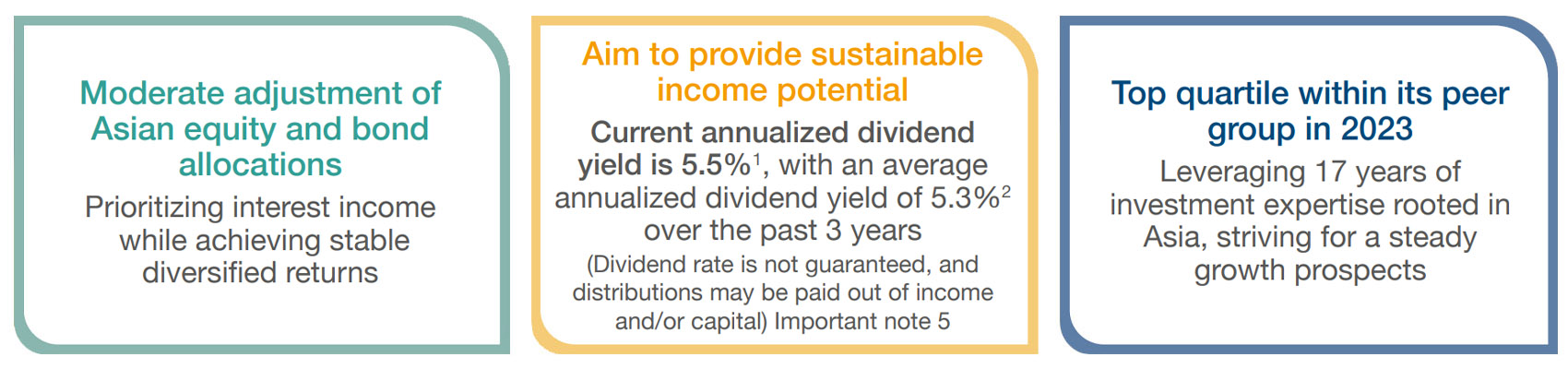

Proactively adapting to market changes, making moderate tweaks in investment strategies

|

|

As the fundamental factors of the global economy gradually become clearer, interest rate expectations are poised for a shift, although they may remain sideways for a period of time. Considering the changes in monetary policies, current investment strategies may require adjustments to effectively address market fluctuations. |

|

|

Diversifying sources of income beyond a single investment tool is the key to generating stable returns. Taking timely and proactive action is beneficial in formulating investment strategies that integrate both income and growth. |

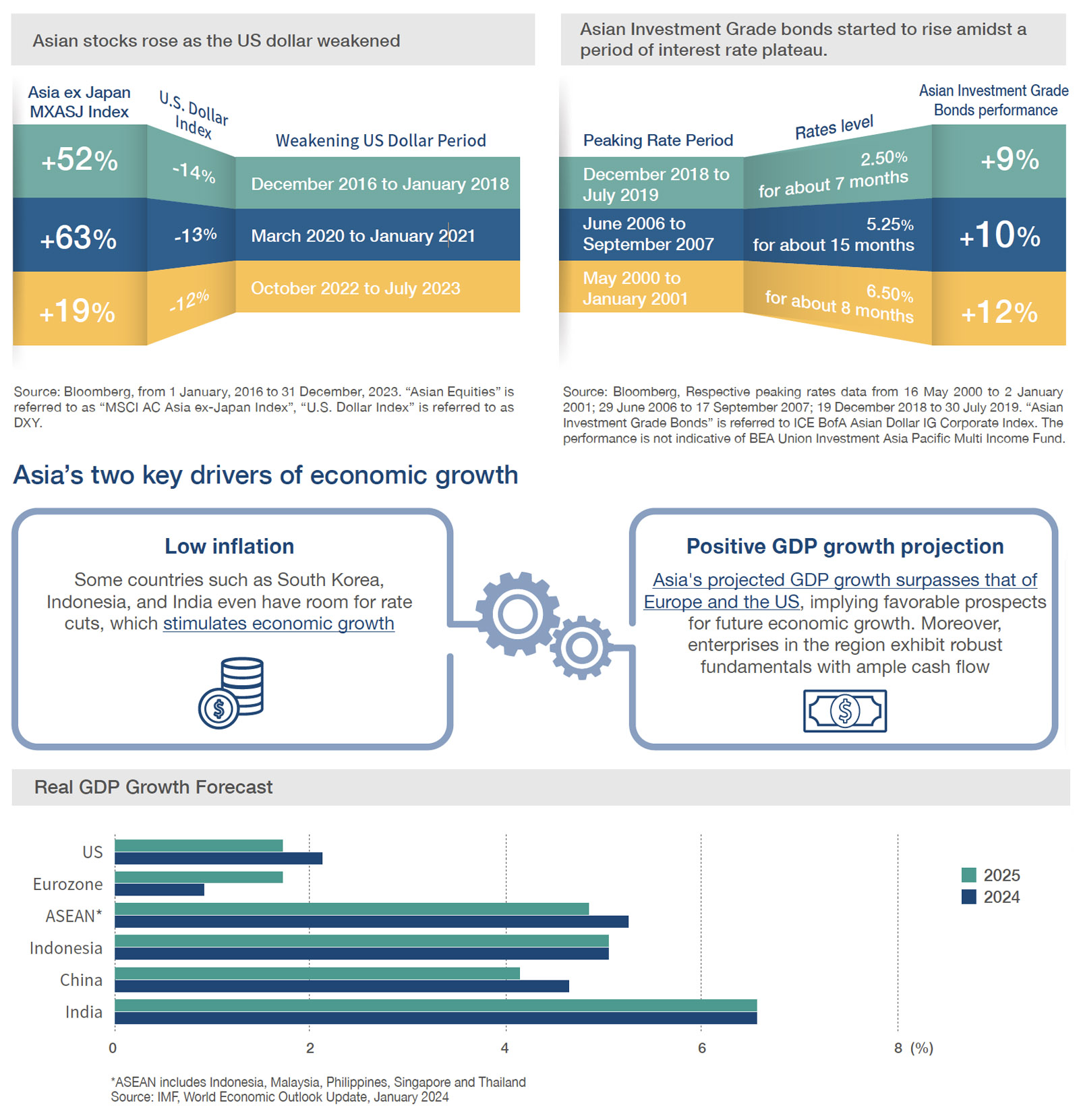

Interest rate shift unlocks investment opportunities in Asian equities and bonds

|

|

Interest rate shift puts pressure on US dollar - With expectations of rate cuts by the Federal Reserve, the USD is likely to face continued pressure. The narrowing interest rate differentials and lower funding costs further incentivize capital investment in Asia, bolstering the attractiveness of equities and bonds. |

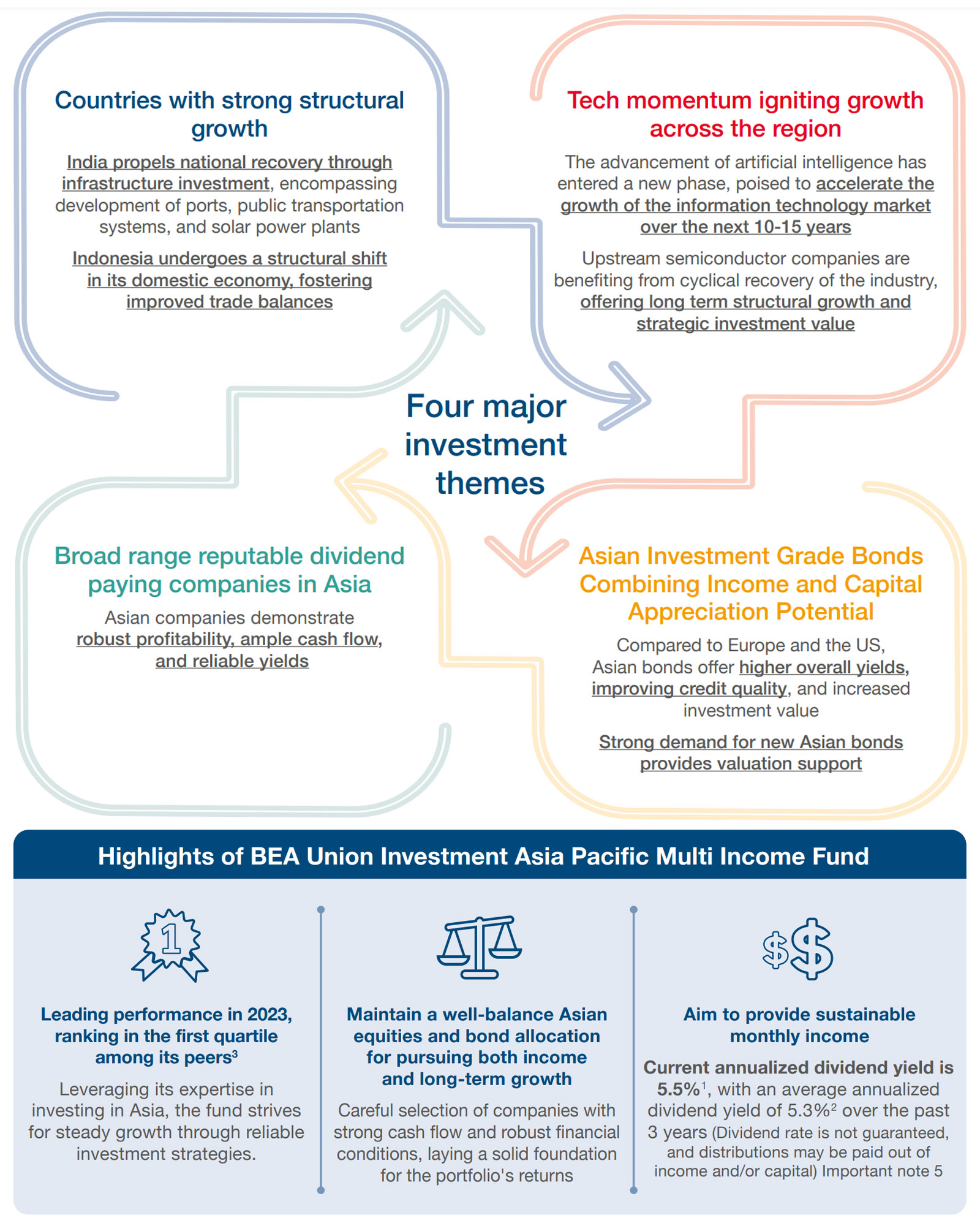

Asia multi-income themes

|

|

BEA Union Investment Asia Pacific Multi Income Fund proactively explores potential investment themes in response to the investment environment, market advantages, and external factors in Asian markets, making strategic deployments. |

|

|

The team conducts investment research with a cautious and meticulous approach, aiming to generate stable multi-income and capital appreciation for equity and bond portfolios, while constructing resilient investment portfolios. |

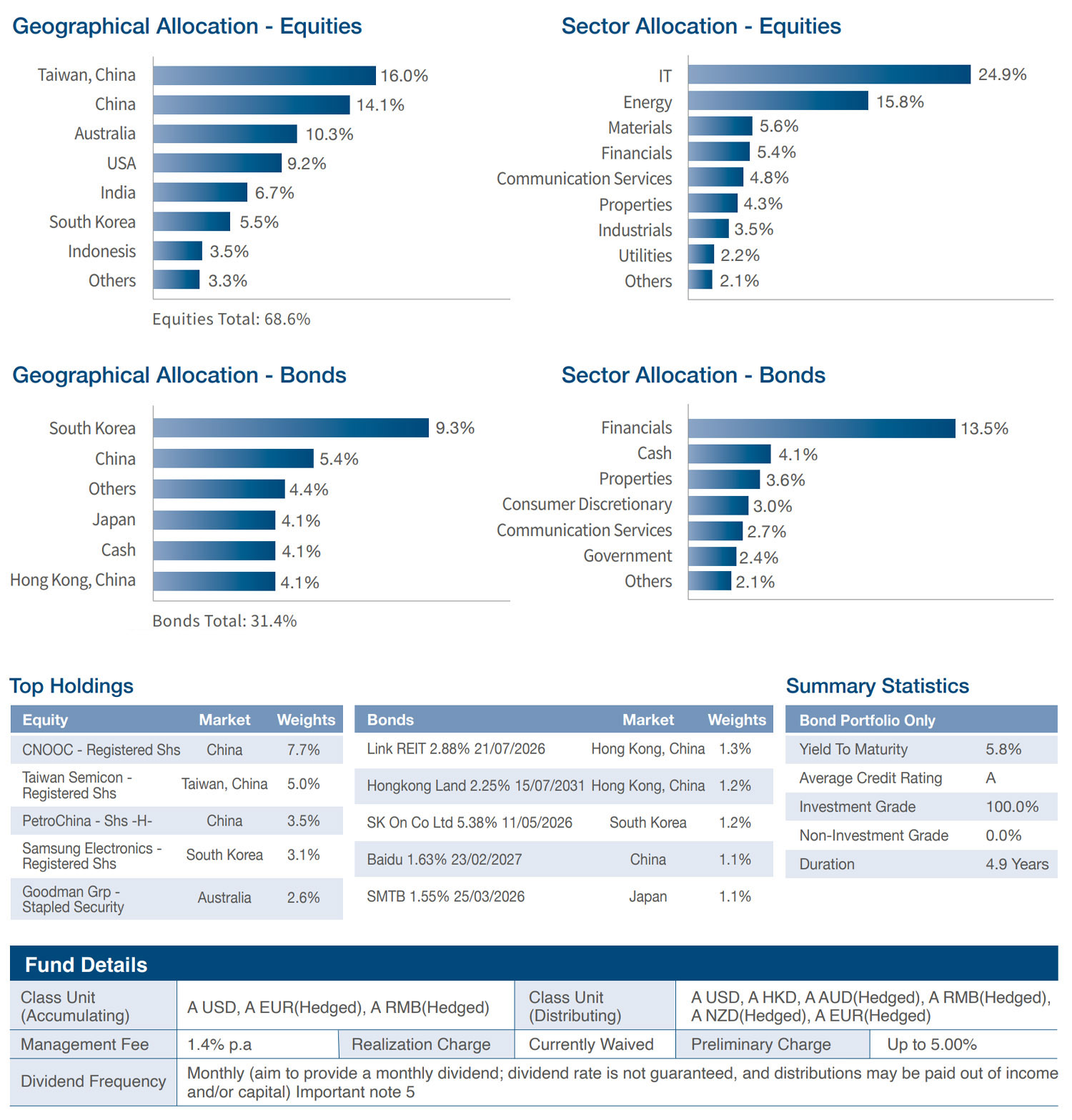

Summary of BEA Union Investment Asia Pacific Multi Income Fund

Source: Unless otherwise specified, all fund data sources are BEA Union Investment as of 31 January 2024. Month-end asset mixes may total greater than/less than 100% due to rounding. As such the values of the geographical and section allocation displayed may not total 100%.

Important note:

1. BEA Union Investment Asia Pacific Multi Income Fund ("the Fund") is subject to general investment risk, equity market risk, asset allocation risk, Asian market concentration risk, emerging market risk and currency risk.

2. The Fund seeks to achieve income and long term capital growth by investing in an actively managed portfolio of debt securities, listed REITs,and other listed securities in the Asia Pacific region.

3. The Fund is subject to equity markets risk such as changes in investment sentiment, political, economic conditions and issuer-specific factors which may adversely affect the fund value.

4. The Fund invests in debts securities and are subject to risks in interest rates, credit/counterparty, downgrading, below investment grade or non-rated securities, volatility and liquidity, valuation and sovereign debt and credit rating risks which may adversely affect the price of the debt securities.

5. The manager may at its discretion make distributions from income and/or capital in respect of the distributing classes of the Fund. Distributions paid out of capital amount to a return or withdrawal of part of the unitholders original investment or from any capital gains attributable to that original investment. Such distribution may result in an immediate reduction of the net asset value per unit.

6. In terms of currency hedged class units, adverse exchange rate fluctuations between the base currency of the Fund and the class currency of the currency hedged class units may result in a decrease in return and/or loss of capital for unitholders. Over-hedged or under-hedged positions may arise and there can be no assurance that the currency hedged class units will be hedged at all times or that the manager will be successful in employing the hedge.

7. RMB is currently not a freely convertible currency as it is subject to exchange controls and restrictions. Non-RMB based (e.g. Hong Kong) investors are exposed to foreign exchange risk and there is no guarantee that the value of RMB against the investors base currencies (for example HKD) will not depreciate. Any depreciation of the RMB could adversely affect the value of investors investments.

8. The Fund may use financial derivative instruments for hedging and investment purposes which may not achieve the intended purpose and may result in significant losses. Risks associated with derivative instruments include counterparty/ credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk.

9. Investors should not make an investment decision based solely on this material.

Investments in the Fund are subject to investment risks, including the possible loss of the principal amount invested. For full details and risk factors of the Fund, please refer to the explanatory memorandum of the Fund. Investors should also read the explanatory memorandum of the Fund for detailed information prior to any subscription. The information contained herein is only a brief introduction to the Fund. Investors should be aware that the price of units may go down as well as up as the investments of the Fund are subject to market fluctuations and to the risks inherent in all investments. Past performance is not indicative of future performance.

The Fund has been authorised by the Securities and Futures Commission ("SFC") in Hong Kong. SFC authorisation is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material and website have not been reviewed by the SFC in Hong Kong.

Issuer: BEA Union Investment Management Limited

1. Source: BEA Union Investment, the mentioned dividend yield is for A USD (Distributing) for January 2024. Annualized dividend yield = (dividend of the current month x 12) / last month end NAV x 100%. Please refer to dividend notice available on website for dividend composition information and details. Past dividend record is not indicative of future dividend likely to be achieved. Please note that a positive distribution yield does not imply a positive return.

2. Source: BEA Union Investment, the mentioned dividend yield is for A USD (Distributing) and is the sum of the monthly annualized dividend yield for the past 36 months, from February 2021 to January 2024 (36 dividends), divided by 36. Annualized dividend yield = (dividend of the current month x 12) / last month end NAV x 100%. Past dividend record is not indicative of future dividend likely to be achieved. Please note that a positive distribution yield does not imply a positive return. The manager may at its discretion make distributions from income and/or capital in respect of the distributing classes of the Fund. Investors should note that the distributions paid out of capital amount to a return or withdrawal of part of the unitholder’s original investment or from any capital gains attributable to that original investment. Such distribution may result in an immediate reduction of the net asset value per unit.

3. Source: Morningstar, data as of 31 January 2024. It is for reference only and should not be construed as buy and sell recommendation of investment. The mentioned performance ranking compares against the annualised performance (total return is calculated in USD) of funds authorized by SFC (authorization does not imply recommendation) which are categorized under Asia allocation category. A USD (Distributing) launched on 11 May 2012. Past performance: 2023: 7.4%; 2022:-23.5%; 2021:-0.8%; 2020:2.6%; 2019:11.9%; YTD (31 January 2024): 1.3%; 1 year: 2.1%; 3 years: -17.9%; 5 years: -8.7%; 10 years: 35.5%. Performance is calculated in Class A USD (Distributing) of the Fund on a NAV to NAV basis.

Main Distributors (In no particular order):