Southeast Asian Countries Offer Opportunities in the Midst of Uncertainty

2022Q4 Market Outlook - Asian Equities

|

Rising interest rates will inevitably cripple economic growth. But as of now, the US job market was robust, while consumer spending held steady. Second-quarter corporate earnings in the US were more resilient than market expectations. If these positive trends can hold firm, even when the lag between rate hikes and their impacts on the economy starts to show effect, there is a greater chance for the US to enter a very mild or mild recession.

Market awash with cash; plan for rates to settle

Global markets will remain volatile as the tug-of-war between inflation versus recession persists. BEA Union Investment maintained a "Neutral" stance on equities until markets are less hazy.

Year-to-date market correction has largely priced in the weak macro backdrop and a very negative view on the geopolitical front. In the near term, sentiment will still swing between inflation and recession worries, fuelling volatilities across equities and US treasury yields. Not until there are signs of clarity, BEA Union Investment will hold a "neutral" stance towards equities. Also, inflationary pressure could ease by the end of this year or early next year. Once inflation and US treasury yields stabilise, and the cloud over economic and corporate health lifted, sentiment and valuation could significantly rebound as liquidity returns.

Favour sectors that are defensive, secular or supported by high commodities prices

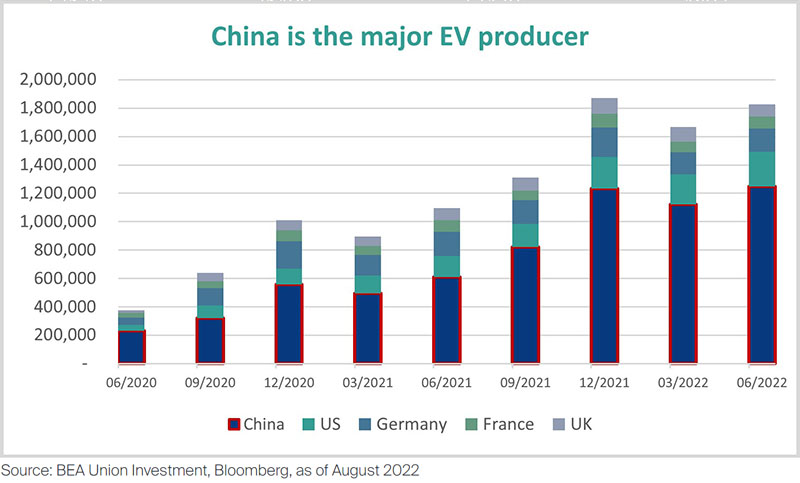

Amid rising risk of an economic downturn, defensive stocks that can generate strong cash flow and enjoy greater earnings clarity are favoured. They include sectors such as energy, non-discretionary and telecom. In addition, all countries are committed to achieving de-carbonization, prompting greater demand for renewables and EV lithium-ion batteries. These are highly competitive areas, and will continue to attract investments from governments and corporates, irrespective of economic conditions. On the other hand, supported by high prices and tight supplies, commodities and raw materials are favoured as hedges against inflation. Our investment teams expect, when rates stabilise and yields start to fall, rate-sensitive growth stocks, which had been significantly underperforming value stocks since late 2021, could stage a rebound. Earnings of technology, media and telecommunications companies might have bottomed out, and the sector could regain momentum once yields stabilise.

Asia enjoys stable fundamentals; inflationary pressure relatively mild

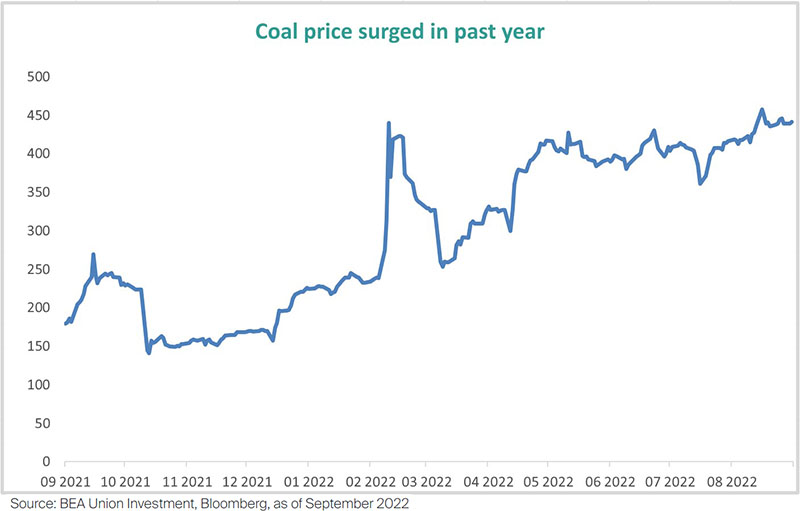

Asian countries faced a bag of mixed fortunes. Albeit Australia, Malaysia, Singapore and South Korea followed the US to raise rates, Asian countries enjoy better economic health and are dealing with more mellow inflationary pressures than their developed peers. South Korea was a case in point. The country was one of the first nations to normalize its interest rates pre-emptively. It had raised rates seven times since August 2021. Its latest, a 25 basis-point hike this August, was more normal in size after a 50 basis-point rise a month earlier. The central bank indicated it will curb inflation via other means instead of implementing outsized rate hike. On the other hand, supported by high coal and palm oil prices, Indonesia's bond and equities markets held up well. Its stock market has risen nearly 10% this year, and its second-quarter GDP grew 3.7% from the previous quarter. Indonesia had not been following the US rate hike trajectory until this August, succumbing to a 25 basis-point increase as inflation gathered steam. High coal prices also provided a boon to Australia, bolstering its second-quarter GDP by 3.6% year-on-year following a 3.3% year-on-year gain in the first quarter.

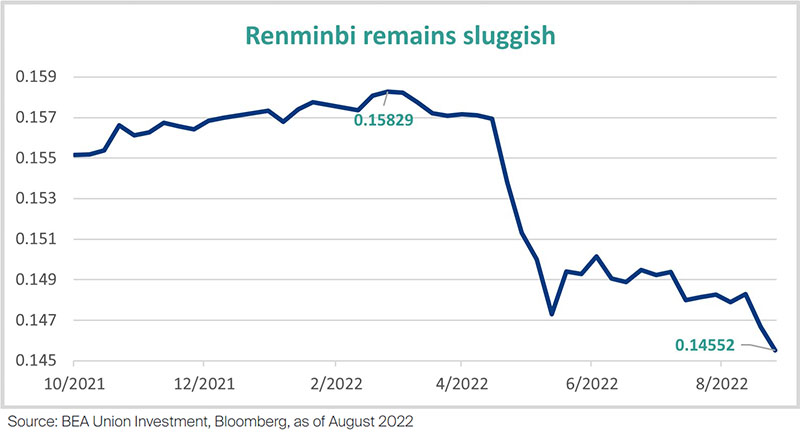

China did not set a GDP growth target for this year. The authorities were counting on an accommodative monetary policy and other easing fiscal measures to prop up economic growth that was hampered by the pandemic policies. And for the second time this year, the PBoC lowered its foreign exchange reserve requirement ratio (RRR) to limit weakness in the Renminbi and to bring the economy back to life. The latest cut brought the country's RRR down to 6% from 8%. But confidence and sentiment could remain depressed as China's beleaguered real estate crisis continued to loom, keeping a lid on Chinese banks and developers shares.

Asian commodities exporters' competitive edge growing; Southeast Asian countries outlook not to be overlooked

BEA Union Investment remained constructive towards the energy sector. Despite easing from their peaks, commodities prices remained elevated, benefiting Indonesia and Australian exporters.

Indonesia offered a relative piece of calm when volatility ripped across global markets. The country posted an account surplus, contributed by robust economic fundamentals, a stable currency, a continually expanding PMI and high palm oil and coal prices. Indonesia did not trace other countries' rate hike trajectory. Only when July inflation rose 4.94% year on year, did the central bank lift rates by 25 basis-point in August. The pace of rate hike was more moderate relative to other nations. Driven by commodities exporters, the country's second-quarter GDP grew 5.4% year on year. The Russia-Ukraine conflict pushed up prices of palm oil and coal, the two primary resources exported by Indonesia, allowing exporters to accrue large cash balances.

Indonesia offered a relative piece of calm when volatility ripped across global markets. The country posted an account surplus, contributed by robust economic fundamentals, a stable currency, a continually expanding PMI and high palm oil and coal prices. Indonesia did not trace other countries' rate hike trajectory. Only when July inflation rose 4.94% year on year, did the central bank lift rates by 25 basis-point in August. The pace of rate hike was more moderate relative to other nations. Driven by commodities exporters, the country's second-quarter GDP grew 5.4% year on year. The Russia-Ukraine conflict pushed up prices of palm oil and coal, the two primary resources exported by Indonesia, allowing exporters to accrue large cash balances.

High coal prices also benefited Australian commodities exporters. Newcastle coal futures, Asia's benchmark contract, hit a record high of US$440/tonne in March. Albeit prices had since eased from their peak, they continued to hover at levels above US$400/tonne, comparing to about US$50-120/tonne recorded in the past decade. Not only did the Russia-Ukraine crisis stifle supplies, European Union's subsequent ban on Russian coal had forced many members to source from as far as Australia. A double whammy for European countries as winter looms and as Russia recently announced the indefinite suspension of natural gas to Europe through its Nord Stream pipeline. This will spur further demand for Asian coal. Supply tightness will be here to stay until next year or beyond.

Prefer Chinese companies with structural growth potential

China's economic recovery is hinged on whether the government will adjust its zero-COVID policy and how fast economic boosting measures will be implemented. Expectations of large-scale easing policies have subsided after Chinese authorities said they expect the country's GDP to grow within a reasonable range. Investor confidence was dampened amid lingering China and US tensions over Taiwan, among other factors. To support the Renminbi, the PBoC cut its RRR the second time this year, bringing it down to 6% from 8% in early September. But the redback will likely remain sluggish against the USD as China-US monetary policies divergence continued to widen.

Buyers of unfinished homes stopped their mortgage payments, while the number of stalling projects rose to more than 300 in late July from about 200. As the government and courts would likely gear towards homebuyer protection, banks could end up having to bear the brunt and absorb most losses. Albeit there have been speculations of rescue funds being offered to developers, our investment teams remained cautious towards Chinese developers and financial sectors lest spill over effects.

On the contrary, opportunities can still be found in secular growth industries, such as, renewables, industrial automation, and domestic consumption. To combat climate change, policies will remain favourable towards electric cars and related sectors as well as renewables. This is an irreversible trend, even if the economy softens. In 2021, the International Energy Agency estimated China could account for 95% of the world's solar energy supply chain by 2025, where building blocks for solar panel production would almost exclusively come from China. Research and development of electric vehicles will remain a highly competitive area, and Chinese firms have been on the forefront of developing lithium-ion batteries for EVs, supplying products to major global electric car makers.

Our investment teams also favoured defensive plays, and those that are capable of share buybacks. As the world teetered on the brink of a recession, our investment teams preferred market leaders, and those that sat on strong balance sheets and free cash flow. Companies that could benefit from supply chain bottlenecks, underinvestment and/or policy changes, were also viewed positively.

Hong Kong shipping names buoyed by supply-demand mismatch

BEA Union Investment continued to strike a balance between growth stocks and cyclical stocks, opting for those with secular growth opportunities in particular. These include EVs and related industries, solar panels and discretionary sectors. Among cyclical stocks, sectors that benefit from a supply-demand mismatch was preferred, such as the shipping and transportation industries. On the other hand, a great deal of investments had already gone to IT projects during the pandemic. In face of an economic slowdown, corporates are likely to ease up on their investments. Hence, we are slightly cautious towards the IT sector.