BEA Union Investment China High Yield Income Fund ("CHY")

Unleash the Growth Potential and Capture the Income Opportunities of China Bond Market

★★★★

Morningstar Overall Rating 1Focus on short-dated bonds

More resilient to rate changes with lower duration risk

Select over 100 high-yield bonds

Capture the opportunities in bond market and mitigate investment risk

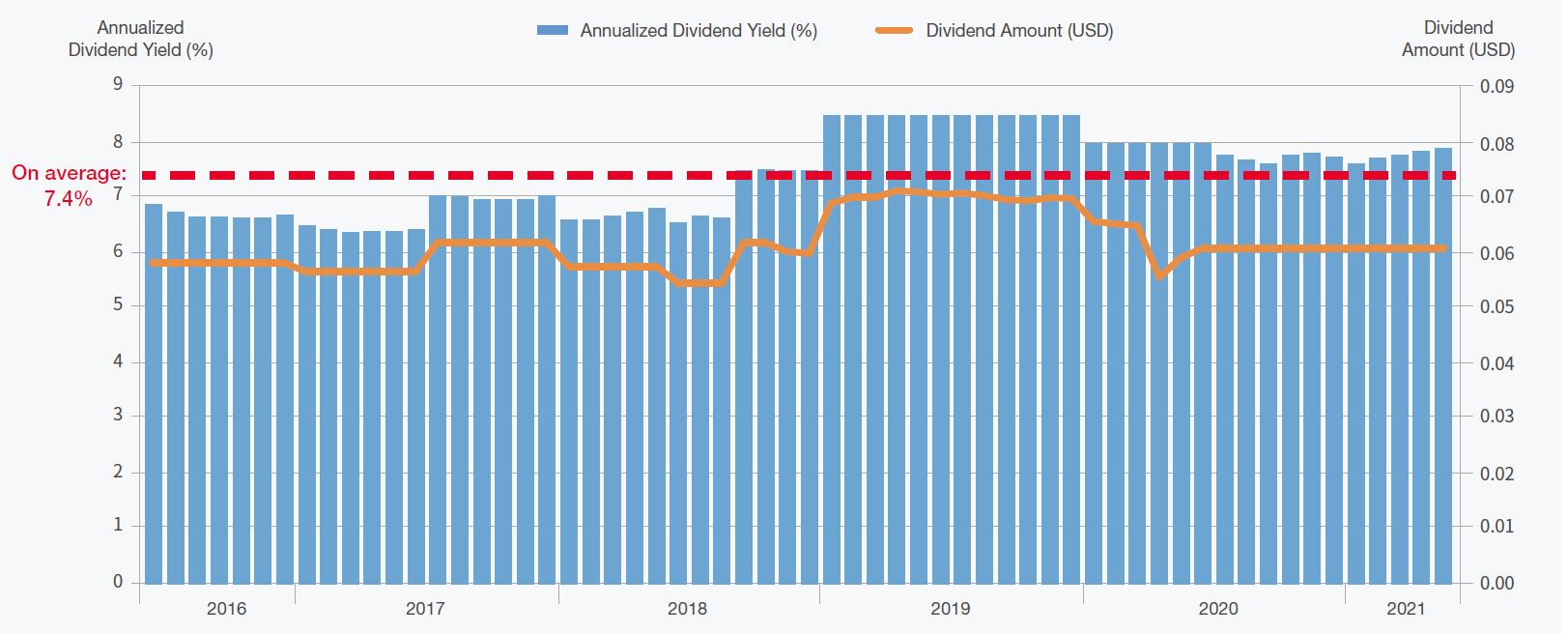

Average annualized dividend rate at 7.4% since launch in 20162

China continues its strong recovery and the economic growth for this year is expected to be leading the world. Coupling with the prospective corporate earnings, the performance of high-yield bonds will be supported.

Advantages of Investing in China High-Yield Bonds

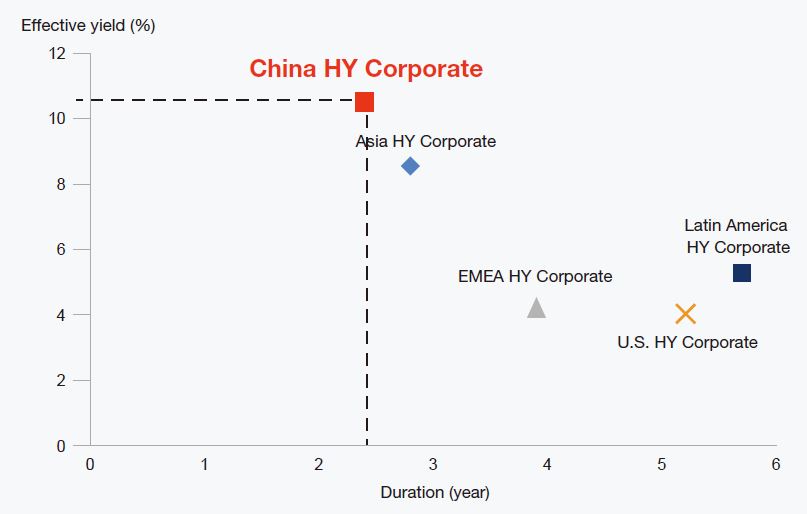

1. Shorter terms with more attractive return

China high-yield bonds provide relatively better returns than its global peers. They have shorter terms and therefore are less sensitive to rate changes. It could serve as a defensive investment deployment.

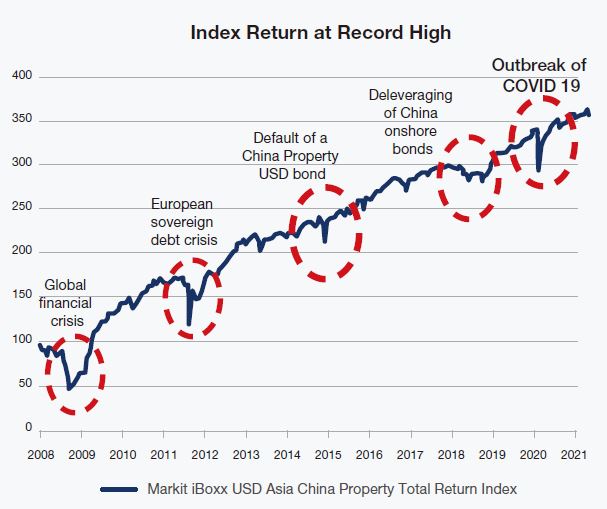

2. Default rates are generally lower

China high-yield bonds have lower default rates compared to its counterparts in the western countries. It shows that they could weather through different economic cycles and give rise to better risk-adjusted returns for investors.

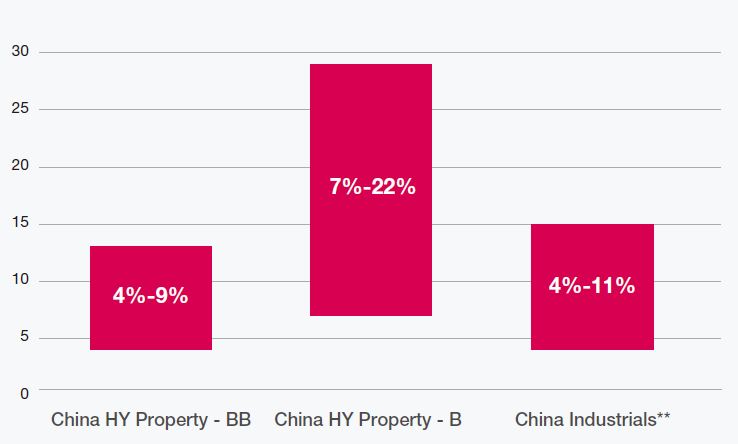

3. Positive outlook on China property market

4. China high-yield bonds offer better yields

BEA Union Investment

China High Yield Income Fund (“CHY”)

Highly selective on quality China high yield bonds

to explore long-term potential return

Stable Dividend Record

Annualized dividend yield at around 7.4% on average over the past 5 years 2

(Aims to provide monthly dividends, dividends are not guaranteed, and distributions may be paid out of income and/or capital) #